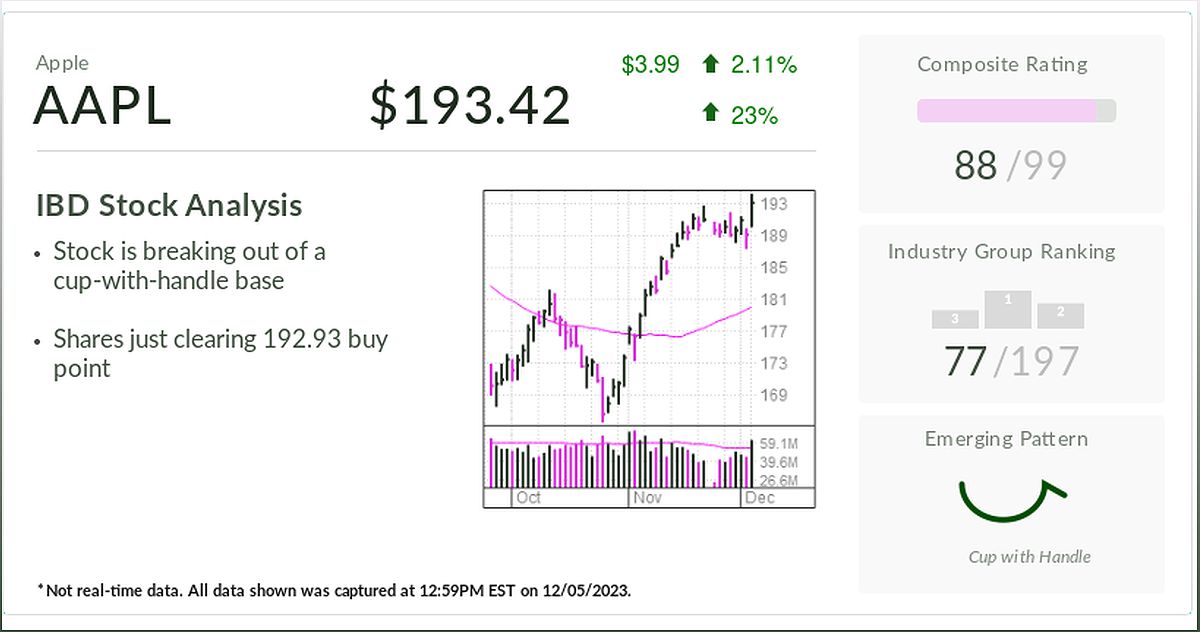

Welcome to the latest update on Apple stock. In this article, we'll explore how Apple's stock is breaking out from a cup-with-handle base, driven by a positive report from a key supplier. This development has sparked optimism and raised expectations for the company's future performance. Let's delve into the details and understand the implications of this breakout for investors.

Positive Report from Supplier Boosts Apple Stock

A positive report from a key supplier has given Apple stock a significant boost, propelling it to break out from a cup-with-handle base. Discover the details behind this positive development and its potential impact on the stock's performance.

Apple stock has recently experienced a breakout from a cup-with-handle base, thanks to a positive report from one of its key suppliers. This report has generated a wave of optimism among investors, leading to increased interest in the stock.

Foxconn, the leading manufacturer of iPhones and a crucial Apple partner, raised its sales outlook for the December-ending quarter. This news has provided a significant boost to Apple stock, pushing it past a $3 trillion market capitalization.

While exact figures were not provided, Foxconn's monthly revenue update indicated better-than-expected sales in the first two months of the fourth quarter. This positive outlook suggests that Apple's fourth-quarter performance may exceed initial expectations.

The report from Foxconn is particularly noteworthy as it reflects the strength of Apple's supply chain and the demand for its products. As a key player in the consumer electronics industry, Apple's stock performance is closely tied to the success of its suppliers and their ability to meet market demand.

Implications for Apple's Market Capitalization

Apple's breakout from the cup-with-handle base has not only sparked investor interest but also pushed its market capitalization to new heights. Explore the significance of this milestone and what it means for the company's valuation.

Apple's recent breakout has propelled its market capitalization to a staggering $3 trillion, making it the world's most valuable company. This achievement is a testament to Apple's strong performance and investor confidence in its future prospects.

With this milestone, Apple joins the exclusive club of the so-called Magnificent Seven companies that have been driving the stock market rally in recent times. This group of companies, including tech giants like Amazon and Microsoft, has played a pivotal role in shaping the overall market trends.

The surge in Apple's market capitalization is a reflection of the market's positive sentiment towards the company. It signifies the market's belief in Apple's ability to deliver consistent growth and innovation, despite facing challenges and competition in the smartphone industry.

Foxconn's Positive Sales Outlook

Foxconn's optimistic sales outlook for the December-ending quarter has further bolstered Apple stock's breakout. Dive into the details of Foxconn's report and its implications for Apple's performance.

Foxconn, the leading manufacturer of iPhones and a crucial Apple partner, has raised its sales outlook for the December-ending quarter. While exact figures were not provided, the company's monthly revenue update indicated better-than-expected sales in the first two months of the quarter.

This positive outlook from Foxconn suggests that Apple's performance in the current quarter may exceed initial expectations. As a key supplier, Foxconn's sales performance is often seen as an indicator of Apple's overall demand and market strength.

Apple investors are closely watching these developments, particularly the sales performance of the latest iPhone models. The holiday season is a crucial period for Apple, and any positive indications from suppliers like Foxconn can significantly impact investor sentiment and drive stock performance.

Analysts' Projections and Market Expectations

Discover what analysts and market experts are projecting for Apple's sales growth and how it aligns with the company's own guidance. Gain insights into the factors that may influence Apple's performance in the coming months.

Apple's most recent earnings report projected flat year-over-year sales growth for the current December-ending quarter. However, analysts have a more optimistic outlook, with an average projection of $118.1 billion in sales, representing a 1% increase from the same quarter last year.

Market expectations are high for Apple, especially considering the potential growth in the number of iPhone users. Goldman Sachs analyst Michael Ng predicts a 3% annual growth in the number of iPhone users through 2027, which could drive long-term sales growth for the company.

However, concerns about competition in the smartphone industry and muted sales at the start of the holiday season have created a cautious sentiment among investors. It remains to be seen how Apple will navigate these challenges and capitalize on its services business to drive future growth.