Welcome to this analysis of Franco-Nevada Corp's dividend performance and growth. In this article, we will delve into the company's dividend history, yield, and growth rates. We will also assess the sustainability of its dividends by examining the payout ratio and profitability. Additionally, we will explore Franco-Nevada Corp's growth metrics and future outlook. Join me as we uncover the key factors that make Franco-Nevada Corp an attractive option for dividend-seeking investors.

Franco-Nevada Corp's Dividend History

Explore the consistent dividend payment record of Franco-Nevada Corp and its status as a dividend achiever.

Franco-Nevada Corp has maintained a consistent dividend payment record since 2008. Dividends are distributed on a quarterly basis, and the company has increased its dividend each year since 2008. This makes Franco-Nevada Corp a dividend achiever, an honor given to companies that have increased their dividend each year for at least the past 15 years.

Investors can rely on Franco-Nevada Corp's track record of consistent dividend payments, providing a steady income stream for shareholders.

Assessing Franco-Nevada Corp's Dividend Yield and Growth

Analyze Franco-Nevada Corp's dividend yield, growth rates, and the expectation of increased dividend payments.

Currently, Franco-Nevada Corp has a 12-month trailing dividend yield of 1.21% and a 12-month forward dividend yield of 1.23%. This suggests an expectation of increased dividend payments over the next 12 months.

Over the past three years, Franco-Nevada Corp has shown an annual dividend growth rate of 10.10%. While the rate decreased to 6.50% per year over a five-year horizon, the company's annual dividends per share growth rate stands at 8.80% over the past decade.

Based on Franco-Nevada Corp's dividend yield and five-year growth rate, the 5-year yield on cost of Franco-Nevada Corp stock as of today is approximately 1.66%.

Evaluating the Sustainability of Franco-Nevada Corp's Dividends

Assess the dividend payout ratio and profitability of Franco-Nevada Corp to determine the sustainability of its dividends.

The dividend payout ratio of Franco-Nevada Corp, as of 2023-09-30, is 0.38. This indicates that the company retains a significant portion of its earnings, ensuring funds for future growth and unexpected downturns.

GuruFocus ranks Franco-Nevada Corp's profitability 9 out of 10, suggesting good profitability prospects. The company has reported positive net income for each year over the past decade, solidifying its high profitability.

With a manageable payout ratio and strong profitability, Franco-Nevada Corp's dividends appear to be sustainable in the long run.

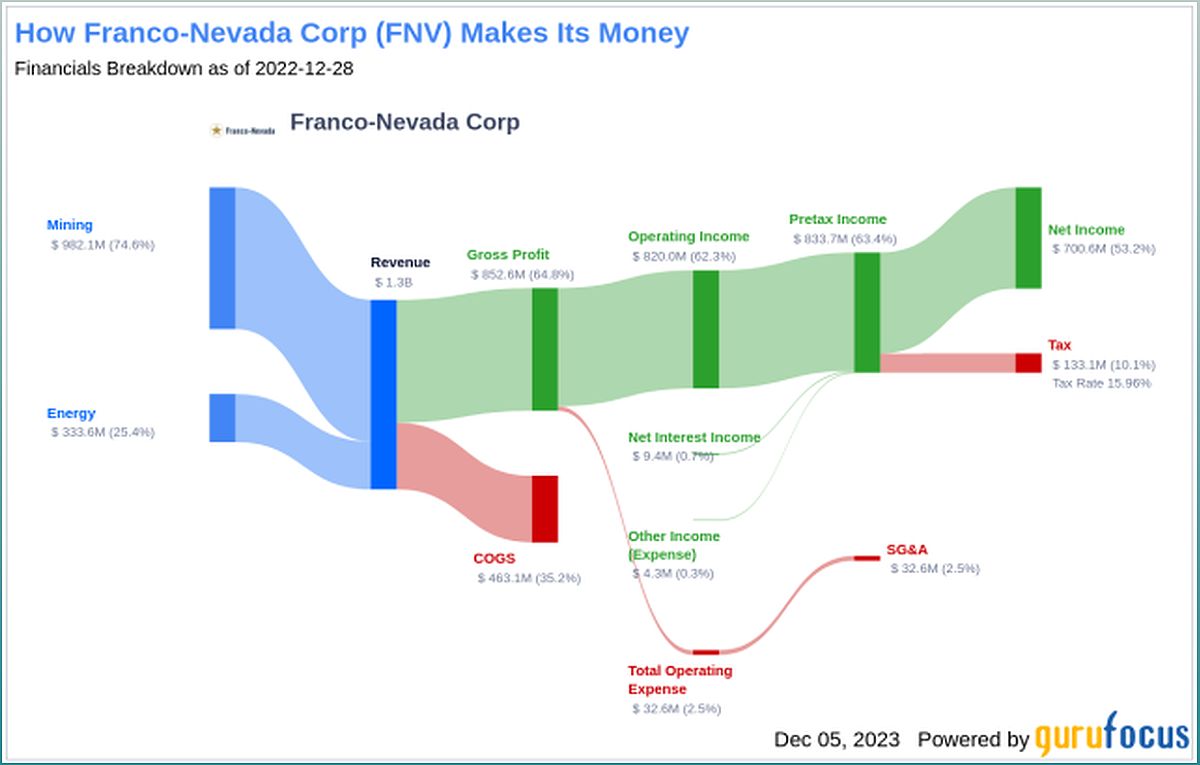

Analyzing Franco-Nevada Corp's Growth Metrics

Examine Franco-Nevada Corp's growth rank, revenue per share, and earnings growth rate to understand its growth trajectory.

Franco-Nevada Corp's growth rank of 9 out of 10 indicates a positive growth trajectory compared to its competitors.

The company's revenue per share has increased by approximately 16.20% per year on average over the past few years, outperforming a significant percentage of global competitors.

Moreover, Franco-Nevada Corp's earnings have grown by approximately 27.40% per year on average over the past three years, outperforming a majority of global competitors.

With a strong growth rank, impressive revenue and earnings growth rates, Franco-Nevada Corp demonstrates its potential for continued growth in the future.