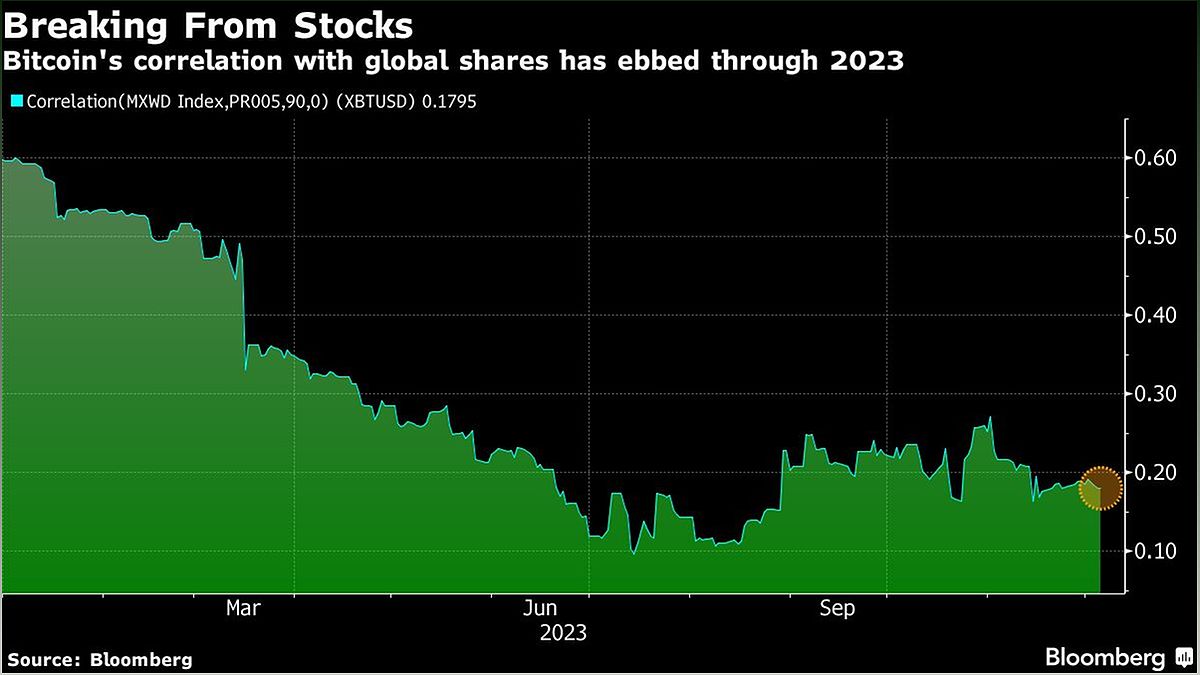

In a surprising turn of events, Bitcoin has reached a new high, surpassing its previous 19-month peak, even as global stock markets experience a downturn. This raises intriguing questions about Bitcoin's ability to decouple from traditional assets. Let's delve into the factors driving this divergence and explore the potential implications for the cryptocurrency market.

Bitcoin's Decoupling from Global Markets

Bitcoin's recent surge to a new high, despite a dip in global stock markets, has caught the attention of investors and analysts. This raises the question of whether Bitcoin is decoupling from traditional assets, such as stocks and bonds.

In the past, Bitcoin's price movements often mirrored those of global markets. However, the current low correlation suggests a shift in the dynamics. This divergence indicates that Bitcoin is becoming less influenced by traditional macroeconomic factors.

One possible explanation for this decoupling is the growing acceptance and recognition of Bitcoin as a legitimate asset class. As institutional investors and corporations embrace cryptocurrencies, Bitcoin's value is increasingly driven by its own unique factors.

It is important to understand the implications of this decoupling for both Bitcoin and traditional markets. Let's explore the potential consequences and what they mean for investors.

Factors Driving Bitcoin's Divergence

Several factors have contributed to Bitcoin's decoupling from traditional assets:

1. Crypto-Specific Factors

Bitcoin's unique characteristics and the growing ecosystem around cryptocurrencies have played a significant role in its divergence. Factors such as the expectation of the US approving Bitcoin exchange-traded funds (ETFs) and positive news about Bitcoin and Ethereum ETFs have driven demand for the token.

2. Regulatory Environment

The regulatory landscape surrounding cryptocurrencies has also influenced Bitcoin's decoupling. The easing of regulatory concerns and the belief that the worst of the US crackdown on the sector is over have boosted confidence among crypto investors.

3. Macro Environment

The macroeconomic environment, including factors like risk appetite and interest rate expectations, can impact Bitcoin's correlation with traditional assets. As the market sentiment turns more favorable towards risk assets and investors anticipate future interest rate cuts, Bitcoin's divergence from global markets becomes more pronounced.

Understanding these factors is crucial for investors seeking to navigate the evolving landscape of the cryptocurrency market.

Implications for Bitcoin and Traditional Markets

The decoupling of Bitcoin from traditional markets carries significant implications:

1. Portfolio Diversification

Bitcoin's reduced correlation with traditional assets offers an opportunity for investors to diversify their portfolios. As Bitcoin becomes less influenced by macroeconomic factors, it can serve as a hedge against market volatility and provide potential long-term growth.

2. Increased Institutional Adoption

The decoupling of Bitcoin from traditional markets may further drive institutional adoption. As Bitcoin gains recognition as a separate asset class, more institutional investors and corporations may allocate funds to cryptocurrencies, contributing to its growth and stability.

3. Market Volatility

Bitcoin's decoupling may also lead to increased volatility in the cryptocurrency market. As Bitcoin becomes less correlated with traditional assets, its price movements may be driven by factors unique to the crypto ecosystem, potentially resulting in more significant price swings.

It is essential for investors to carefully consider these implications and adjust their strategies accordingly in response to Bitcoin's decoupling from traditional markets.