As Nvidia's shares continue to soar, questions arise about the sustainability of its success. In this article, Jennifer Davis, a renowned content writer and financial analyst, delves into the recent performance of Nvidia and explores the potential challenges that may lie ahead. Join us as we uncover the insights and expert analysis from Jennifer Davis, shedding light on whether Nvidia's reign as a market leader can withstand the test of time.

Nvidia's Impressive Performance in 2023

Nvidia has experienced an exceptional year, with its shares skyrocketing by approximately 220% in 2023. As the leading performer in the S&P 500, the California-based chipmaking giant has surpassed all expectations.

Revenue has surged by 34% from the previous quarter and an impressive 206% from the previous year. These outstanding figures have not only solidified Nvidia's position in the market but have also led to increased optimism about its future prospects.

Concerns and Doubts for Nvidia's Future

Despite Nvidia's remarkable performance, there are growing concerns about the company's ability to maintain its dominance in the long run. Executives selling off their shares and new restrictions on chip exports to China have raised eyebrows among investors.

Furthermore, questions arise about the sustainability of Nvidia's exponential growth. Can a company with a market cap of $1.2 trillion continue to expand at such a rapid pace? These uncertainties cast a shadow over Nvidia's future prospects.

Nvidia's Focus on AI: A Key to Sustained Success

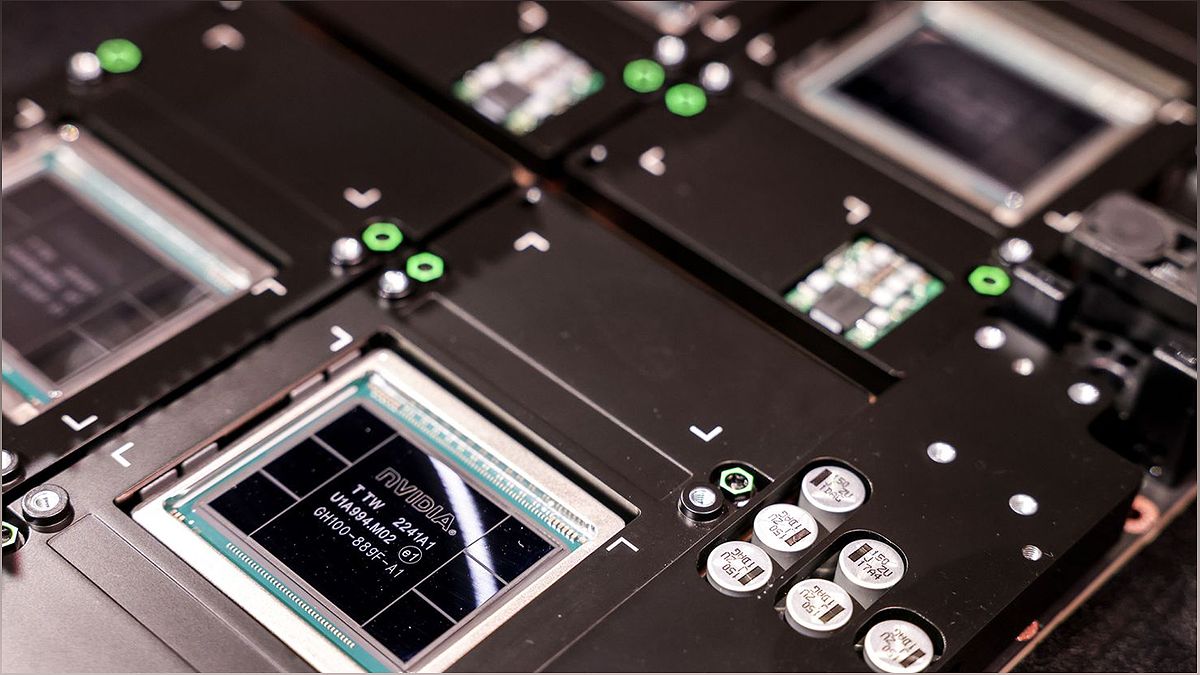

Nvidia has strategically positioned itself as a key player in the AI industry. By capitalizing on the AI trend, much like it did with cryptocurrency, Nvidia has positioned itself as a provider of essential tools for the AI gold rush.

With the transformative potential of AI, many experts believe that Nvidia is well-positioned to benefit from the projected $1 trillion of AI spend over the next decade. By leading the way in chip and software sectors, Nvidia aims to maintain its success in the ever-evolving tech landscape.

Expert Insights and Market Analysis

Renowned financial analysts and institutions have provided their perspectives on Nvidia's future. Goldman Sachs analysts predict a 34% upside for Nvidia in the next 12 months, while Piper Sandler analyst Harsh Kumar believes the company is undervalued and has room for further growth.

However, not everyone shares the same level of optimism. Some experts caution that sustaining Nvidia's valuation requires consistent growth and increased demand, which may not be guaranteed in the highly competitive market.

Navigating Uncertainty: Risks and Potential Pitfalls

While Nvidia's future appears promising, there are several risks that could impact its trajectory. The recent selling of shares by company executives raises concerns about insider sentiment. Additionally, new export controls on chip shipments to China could have a negative impact on Nvidia's business.

Furthermore, sustaining rapid growth and meeting high market expectations pose ongoing challenges for Nvidia. Investors must carefully evaluate these risks and consider the potential impact on the company's future performance.