XP Inc (XP) has recently experienced market fluctuations, but is it undervalued? In this article, we delve into a valuation analysis to uncover the true value of XP Inc (XP). We'll explore the company's financial strength, profitability, and growth potential to determine if it's a worthwhile investment.

Valuation Analysis of XP Inc (XP)

Uncover the true value of XP Inc (XP) through a comprehensive valuation analysis.

Valuing a company is essential for investors to make informed decisions. In this section, we will conduct a thorough valuation analysis of XP Inc (XP) to determine if it is undervalued or overvalued.

By examining various factors such as financial strength, profitability, and growth potential, we can gain insights into the company's true value. Let's dive into the details and see what the analysis reveals.

Financial Strength: A Concerning Factor

Evaluate the financial strength of XP Inc (XP) and its impact on the company's valuation.

Assessing a company's financial strength is crucial for investors to avoid potential risks. XP Inc's cash-to-debt ratio of 1.13 raises concerns, as it ranks lower than its industry peers. This indicates a weaker balance sheet compared to its competitors.

With a rating of 3 out of 10 for financial strength, it is important to consider this factor when determining the overall valuation of XP Inc (XP).

Profitability and Growth: A Mixed Picture

Analyze the profitability and growth potential of XP Inc (XP) to assess its value.

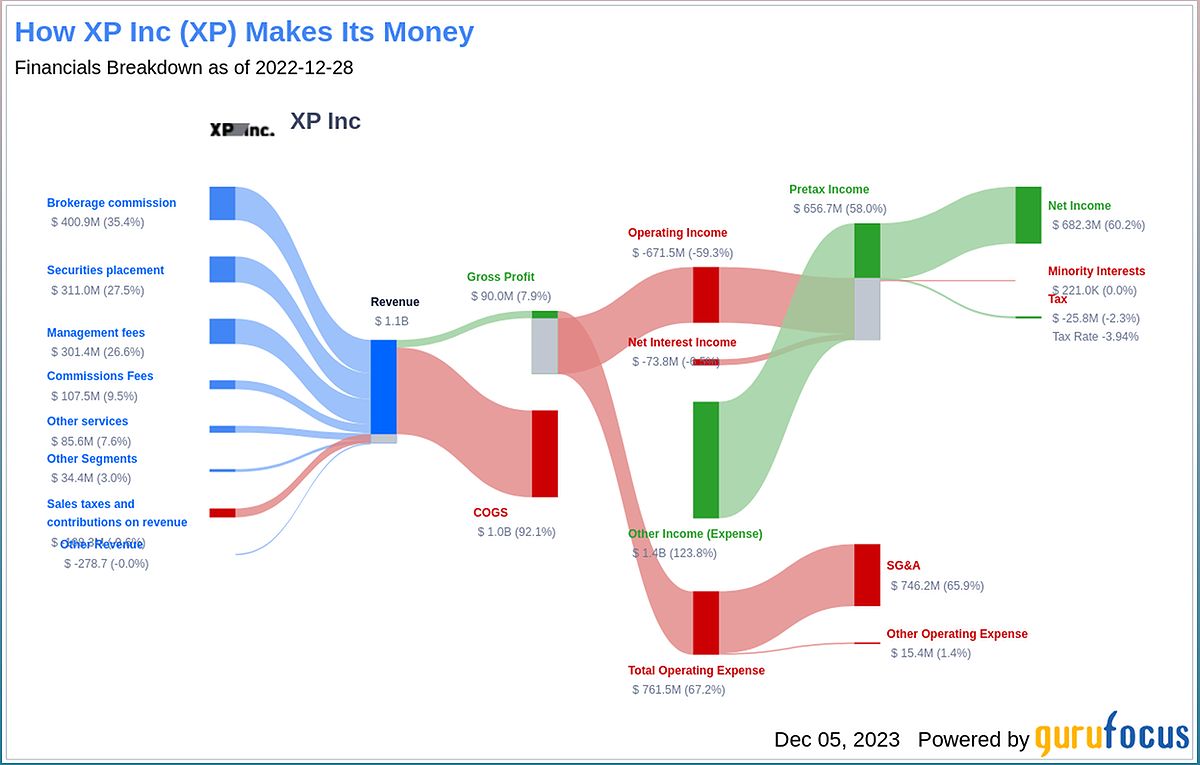

Examining a company's profitability is crucial in determining its value. XP Inc has been profitable for 7 out of the past 10 years, which indicates a consistent track record.

However, the company's operating margin of -57.03% is lower than its industry peers, suggesting room for improvement. When it comes to growth, XP Inc's 3-year average annual revenue growth rate is below average, but its 3-year average EBITDA growth rate outperforms the majority of its competitors.

Considering these factors, it is important to weigh the profitability and growth potential of XP Inc when assessing its overall valuation.

ROIC vs. WACC: Efficiency and Returns

Compare XP Inc's (XP) Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC) to evaluate efficiency and returns.

Assessing a company's efficiency in generating returns on invested capital is crucial for investors. XP Inc's current ROIC of -1.77 indicates inefficiency in generating sufficient returns.

Comparing this to the company's WACC of 7.75, it becomes evident that XP Inc needs to improve its efficiency to generate higher returns. This comparison provides insights into the company's overall valuation and investment potential.