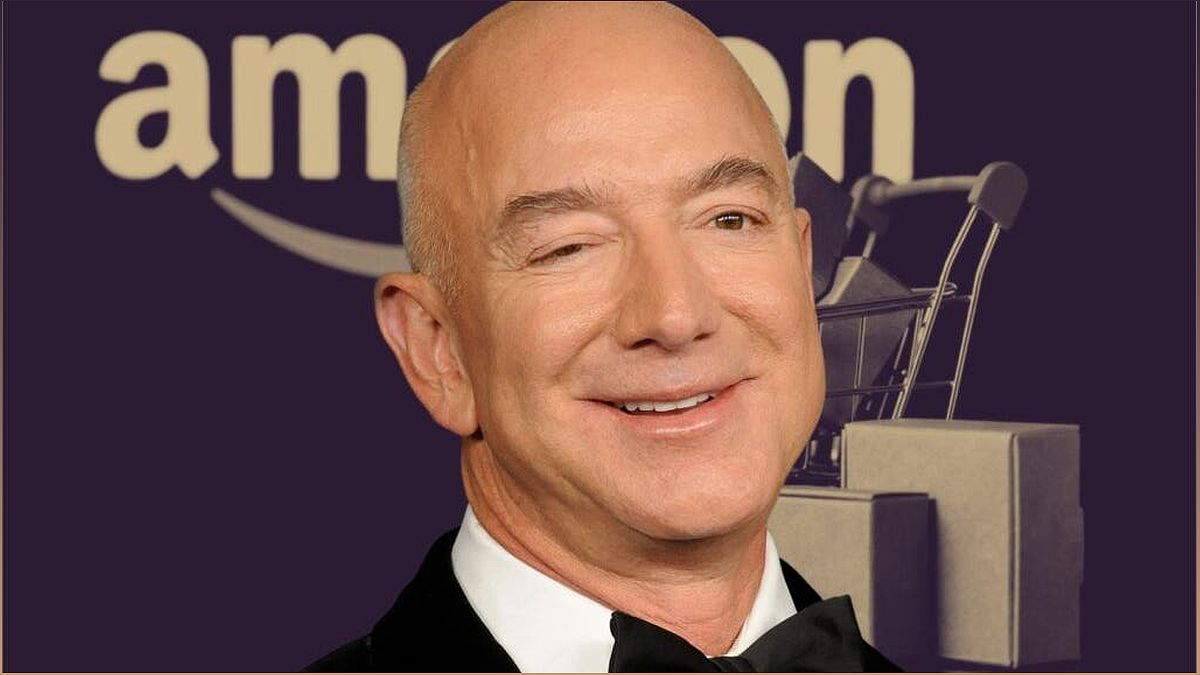

Welcome to this insightful article where we delve into the philosophy of Jeff Bezos, the former Amazon CEO. Join me as we explore Bezos' distinctive view on stock market dynamics and company growth, and why he believes that focusing on business fundamentals is key. Discover how Bezos' approach can provide valuable lessons for investors and entrepreneurs in navigating the ever-changing world of the stock market.

Jeff Bezos' Unique Perspective on Stock Market Dynamics

Jeff Bezos, the former Amazon CEO, has a unique perspective on stock market dynamics. Unlike many investors, Bezos doesn't spend time obsessing over daily stock prices. He believes that short-term fluctuations don't reflect the true value of a company.

During an interview, Bezos emphasized that the stock is not the company, and the company is not the stock. He encourages his team to focus on the underlying fundamentals of the business rather than getting caught up in the ups and downs of the stock market.

This philosophy highlights the importance of looking beyond the stock market and focusing on the long-term growth and success of a company.

The Significance of Business Fundamentals

Jeff Bezos firmly believes in the significance of business fundamentals. He advises his team not to get carried away by short-term stock performance, whether positive or negative.

According to Bezos, a company's fundamentals, including its business model, leadership, and market position, are the true indicators of long-term success. By focusing on these core aspects, companies can weather the volatility of the stock market and continue to grow.

Bezos' approach reminds investors and entrepreneurs to prioritize the underlying strengths of a business rather than being swayed by market trends.

Amazon's Journey: From Garage Startup to Multinational Corporation

Amazon's journey is nothing short of remarkable. It all started in 1994 when Jeff Bezos, inspired by the rapid growth of the internet, founded the company with an initial investment of $245,573.

From its humble beginnings as a garage startup, Amazon has grown into a multinational corporation worth $1.6 trillion. The company's success can be attributed to its innovative business model and expansion into various sectors, including logistics, consumer technology, cloud computing, and media and entertainment.

Today, Amazon is a global powerhouse, serving millions of customers worldwide and continuously pushing the boundaries of e-commerce and technology.

Amazon's Growth and Financial Performance

Over the past five years, Amazon has experienced significant growth in revenue. In 2018, the company's revenue stood at $232 billion, and it has now soared to $514 billion in 2022, marking a 121% increase.

One of the key drivers of Amazon's growth is its expansion into new markets and continuous enhancement of its e-commerce business model. Additionally, the company's AWS business segment has made a significant contribution to its revenue.

However, despite its impressive market cap and revenue growth, Amazon reported a net loss of $2.7 billion in 2022. This highlights the dichotomy between market valuation and profitability, reminding us that a company's stock performance may not always align with its financial results.

Lessons for Investors and Entrepreneurs

Jeff Bezos' approach offers valuable lessons for investors and entrepreneurs alike. His emphasis on focusing on the underlying fundamentals of a company rather than short-term market trends is crucial.

Investors can learn the importance of conducting thorough evaluations of a company's vision, leadership, and market potential before making investment decisions. Similarly, entrepreneurs can take inspiration from Bezos' long-term strategy and commitment to innovation.

By embracing a deep understanding of business fundamentals and adopting a long-term perspective, investors and entrepreneurs can navigate the stock market with more confidence and make informed decisions.