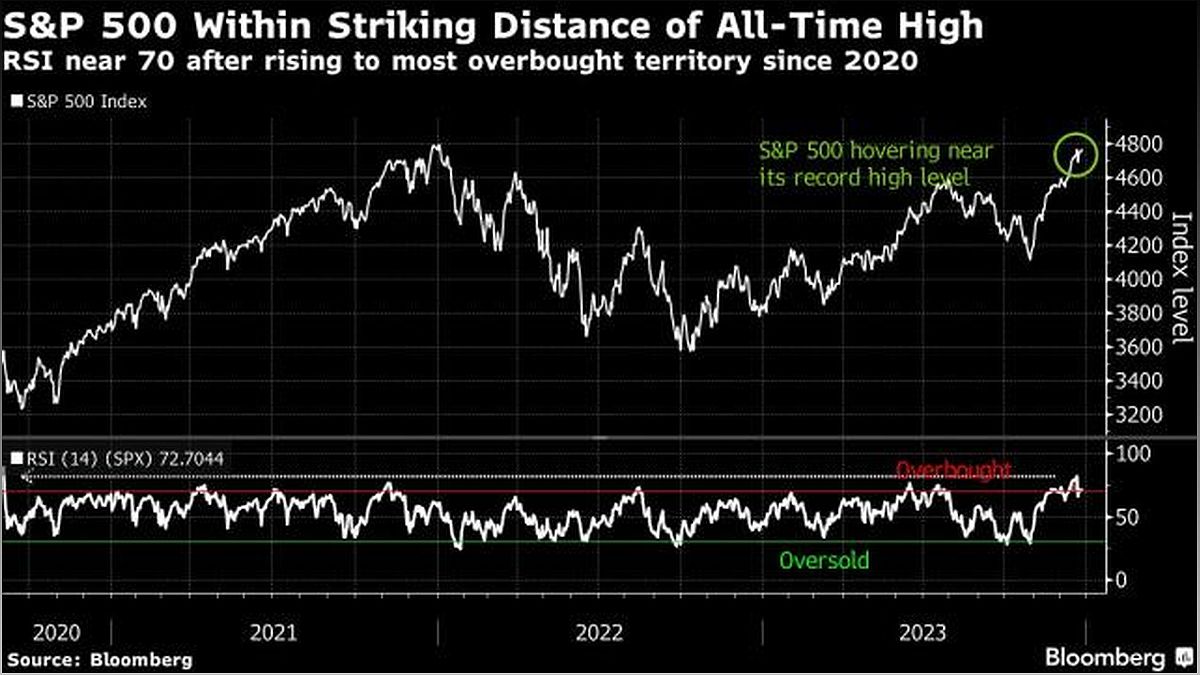

The stock market is experiencing a struggle as investors place their bets on potential rate cuts by the Federal Reserve. With the S&P 500 nearing a record high, traders are cautious about overbought levels and overly dovish Fed wagers. In this analysis, we explore the impact of the 'Santa rally' and the need for new catalysts to drive the market to new all-time highs. Stay informed about the latest market trends and gain insights into potential factors that could shape the future of the S&P 500.

The Impact of Rate Cut Bets

Investors are closely monitoring the stock market as bets on potential rate cuts by the Federal Reserve gain momentum. Traders have increased their expectations of rate cuts as early as March 2024, following the updated forecasts by policymakers. The impact of these rate cut bets is evident in the cautious trading and concerns about overbought levels.

What are the potential consequences of rate cuts by the Federal Reserve? How will these bets shape the future of the stock market? Let's delve deeper into the implications of these rate cut expectations and their influence on investor sentiment.

The 'Santa Rally' and Investor Complacency

The recent 'Santa rally' has led to a sense of complacency among investors. The market's near-record highs have left many feeling optimistic, but also potentially vulnerable to a reality check. As we approach the new year, it becomes crucial to assess the impact of this rally on investor sentiment and market dynamics.

Is investor complacency justified in the current market conditions? What are the potential risks associated with this sentiment? Let's examine the implications of the 'Santa rally' and its implications for the future performance of the stock market.

The Need for New Catalysts

As we enter the new year, the S&P 500 is inching closer to its all-time high. However, sustaining this momentum and reaching new record levels will require fresh catalysts. The market needs positive triggers to propel it beyond the current levels and establish new all-time highs.

What are the potential catalysts that could drive the S&P 500 to new heights? How can investors identify and capitalize on these opportunities? Let's explore the importance of new catalysts and their role in shaping the future performance of the stock market.

Navigating Overbought Levels and Dovish Fed Wagers

The stock market is currently facing challenges posed by overbought levels and overly dovish wagers on the Federal Reserve's actions. These factors have raised concerns among traders and analysts, highlighting the need for caution and a reality check.

How can investors navigate these challenges and mitigate potential risks? What strategies can be employed to balance portfolios in the face of overbought levels and dovish Fed expectations? Let's delve into the intricacies of these market dynamics and explore potential approaches for investors.