Selling all your stocks at the right time and buying at the perfect moment sounds like a winning strategy, but is it really? In this article, we'll explore the truth about market timing and why it's a challenging feat even for professional traders. Instead, we'll delve into a new study that provides evidence for the effectiveness of aiming for average returns. By embracing a simple, unspectacular strategy of buying and holding low-cost index funds, you may increase your odds of success in the stock market. Let's dive in and uncover the secrets to achieving financial stability.

The Illusion of Market Timing

Many investors are lured by the idea of market timing, the ability to sell stocks before a market decline and buy them back before a rise. However, this strategy is often an illusion. Countless studies have shown that even professional traders struggle to time the market accurately.

The truth is, market movements are influenced by a multitude of factors, including economic conditions, geopolitical events, and investor sentiment. Trying to predict these variables with precision is a daunting task. It's important to recognize that market timing is more about luck than skill.

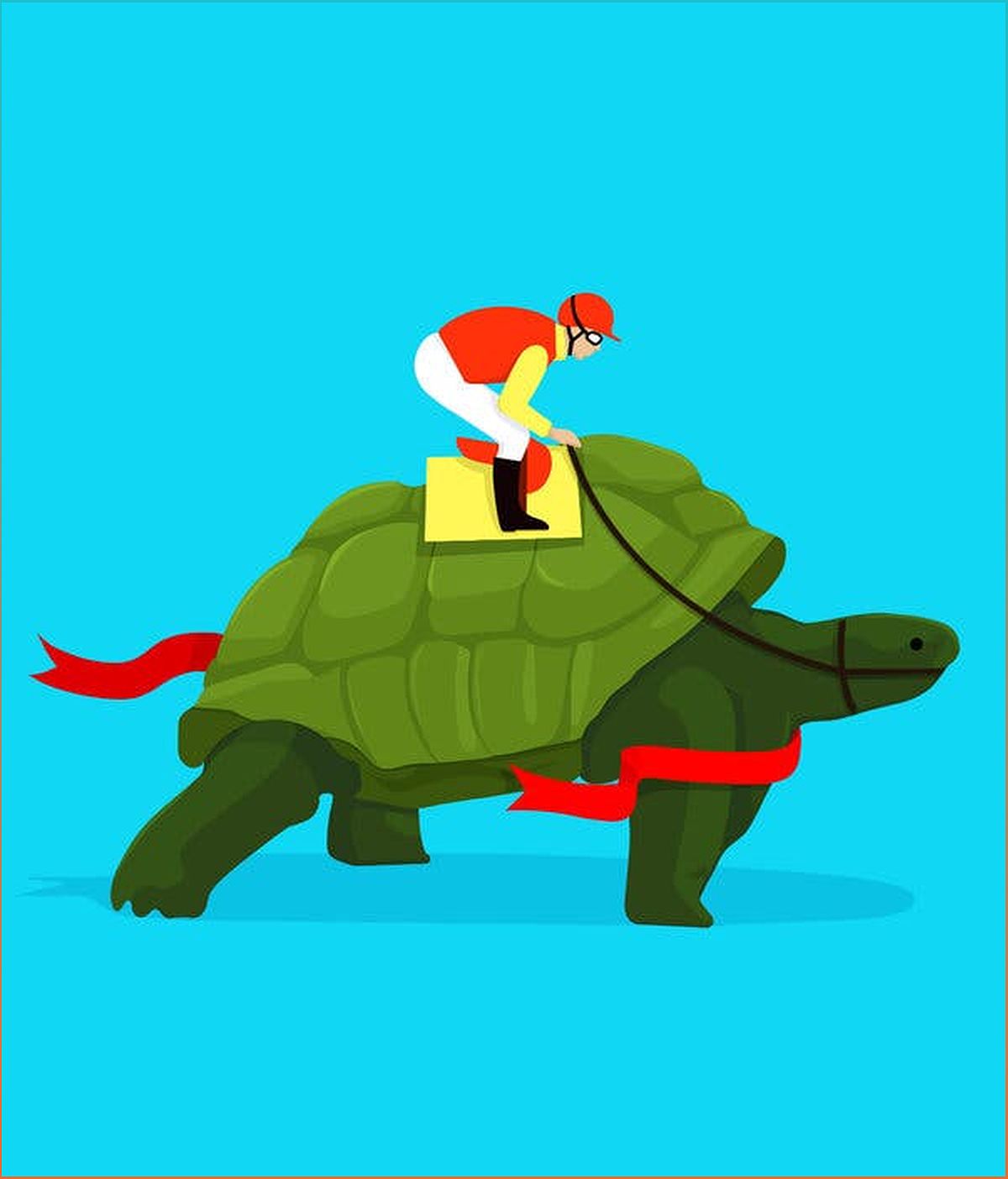

Instead of chasing the illusion of market timing, a more realistic approach is to accept that the stock market moves in cycles. It's essential to focus on long-term investment strategies that aim for average returns rather than trying to outsmart the market.

The Study That Debunks Market Timing

A recent study conducted by investment research firm Dimensional Fund Advisors examined various market timing strategies. Out of the 720 strategies tested, only a few showed any success. However, upon closer examination, these strategies were found to be based on luck rather than a reliable method.

The study's most effective strategy involved abandoning stocks and investing in safe Treasury bills during market downturns. While this approach outperformed a buy-and-hold strategy in certain markets, it was highly specific and not guaranteed to work consistently.

The findings of this study reinforce the idea that market timing is a challenging endeavor. Instead, the study suggests that a simple buy-and-hold strategy, such as investing in low-cost index funds, is a more reliable approach for most investors.

The Pitfalls of Timing the Market

Timing the market requires making two correct decisions: when to sell and when to buy back in. Unfortunately, getting both decisions right consistently is incredibly challenging, even for experienced investors.

One of the main pitfalls of market timing is the risk of missing out on market gains. Trying to time the market often leads to sitting on the sidelines during periods of growth, resulting in missed opportunities for potential returns.

Moreover, market timing can also lead to emotional decision-making. Investors may panic and sell during market downturns, only to buy back at higher prices when the market recovers. This behavior can significantly impact long-term investment performance.

Instead of trying to time the market, it's crucial to adopt a disciplined investment approach. By staying invested in the market over the long term and diversifying your portfolio, you can capture the overall market returns and mitigate the risks associated with market timing.

The Case for Average Returns

While the idea of achieving extraordinary returns in the stock market is enticing, it's important to recognize that consistently outperforming the market is exceedingly rare.

Instead of chasing elusive high returns, a more practical approach is to focus on achieving average returns. By investing in broad, diversified, and low-cost index funds, you can align your investment strategy with the overall market performance.

This approach, known as passive investing, aims to minimize costs and maximize market returns. It acknowledges the difficulty of beating the market consistently and emphasizes the importance of long-term investment horizons.

By striving for average returns, you can avoid the pitfalls of market timing and reduce the impact of emotional decision-making. It's a strategy that aligns with the principles of consistency, efficiency, and long-term financial stability.