The U.S. stock market is currently witnessing a significant uptrend, with a majority of sectors in the S&P 500 reaching 52-week highs. This broad rally is a departure from the narrow leadership that characterized much of 2023. According to Bespoke Investment Group, six out of eleven S&P 500 sectors traded at 52-week highs recently, marking the highest share of sectors simultaneously hitting these highs since May 2021. This occurrence is relatively uncommon, based on historical data dating back to 1990. While the immediate implications of this trend may indicate weaker-than-average returns in the near term, historical norms suggest that the longer-term returns are likely to align with expectations. The stock market's recent performance has been driven by sectors such as information technology, communication services, and consumer discretionary, with companies like Nvidia, Meta Platforms Inc., and Tesla leading the way with substantial gains. However, it's worth noting that not all sectors have experienced positive growth, with consumer staples, energy, utilities, and healthcare seeing losses year to date. As investors navigate these market dynamics, it's crucial to stay informed and consider the historical context to make well-informed decisions.

The Broader Rally in the U.S. Stock Market

The U.S. stock market is currently experiencing a broader rally, with a majority of sectors in the S&P 500 reaching 52-week highs. This departure from the narrow leadership seen in 2023 indicates a shift in market dynamics.

Historically, a majority of S&P 500 sectors hitting new 52-week highs on the same day has been followed by weaker-than-average returns in the near term. However, over the longer term, returns tend to align with historical norms.

Investors should pay attention to this trend and consider its implications when making investment decisions. It is essential to analyze the performance of individual sectors and companies within the broader market context.

Leading Sectors Driving the Market

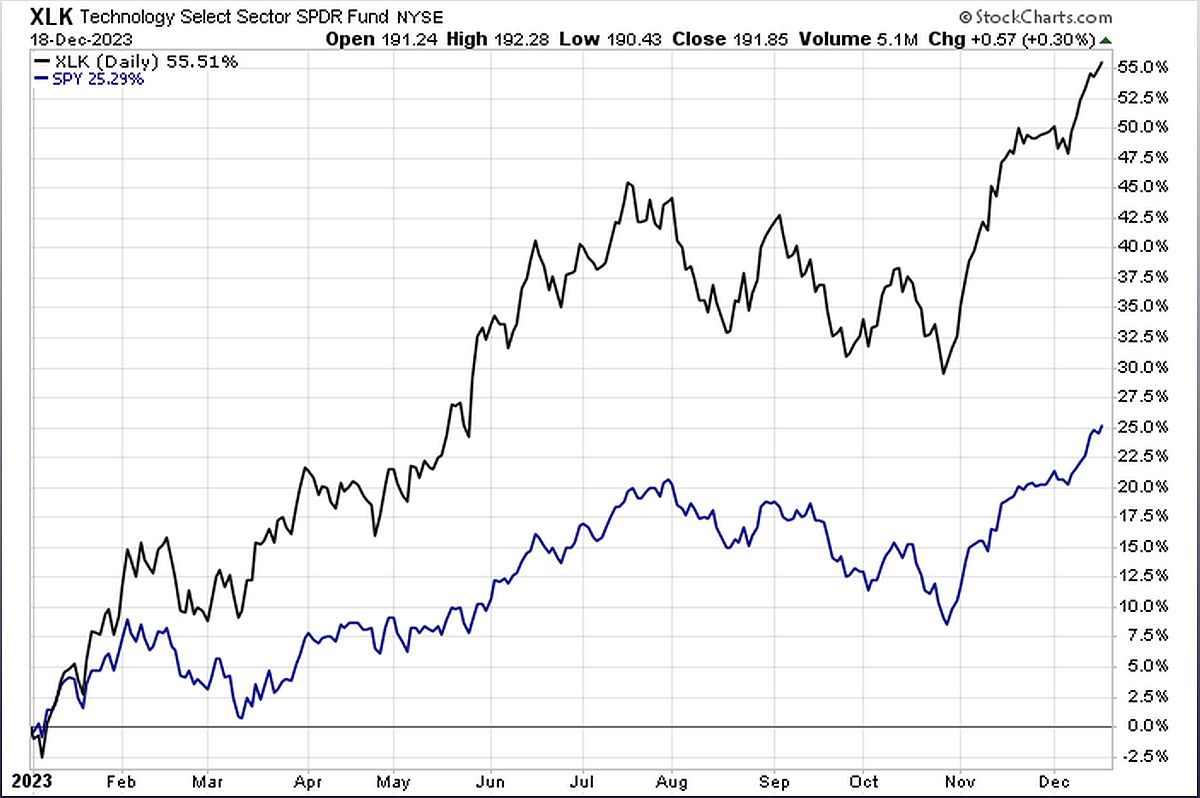

The recent surge in the U.S. stock market has been driven by sectors such as information technology, communication services, and consumer discretionary. These sectors have seen significant gains, with companies like Nvidia, Meta Platforms Inc., and Tesla leading the way.

For example, Nvidia has experienced a remarkable increase of around 232% so far this year, while Meta Platforms Inc. has soared around 191% and Tesla has surged around 103%. These companies, often referred to as the 'Magnificent Seven' or 'Big Tech,' have played a crucial role in driving the overall market performance.

However, it's important to note that not all sectors have experienced positive growth. Sectors such as consumer staples, energy, utilities, and healthcare have seen losses year to date. Investors should carefully evaluate the performance of different sectors and diversify their portfolios accordingly.

Implications for Investors

While the broader rally in the U.S. stock market may indicate short-term volatility and potential weaker returns, it is crucial for investors to consider the historical context and longer-term trends.

Investors should focus on analyzing individual sectors and companies, rather than solely relying on the overall market performance. This will help them identify opportunities and make informed investment decisions.

Additionally, investors should diversify their portfolios across different sectors and asset classes to mitigate risks and take advantage of potential growth opportunities. Staying informed about market dynamics and conducting thorough research is key to navigating the current market environment.