As we approach the end of the year, Wall Street is buzzing with bullish signals for the stock market. Analysts predict that the S&P 500 could reach new heights, and renowned stock watcher Jeremy Siegel believes the Dow Jones could hit an all-time high. However, there's one potential obstacle standing in the way: the Federal Reserve's unwavering commitment to its 2% inflation target. In this article, we'll explore how the Fed's inflation target could impact the Dow Jones and its prospects for continued growth.

The Potential Impact of the Federal Reserve's Inflation Target

Explore how the Federal Reserve's commitment to its inflation target could affect the Dow Jones.

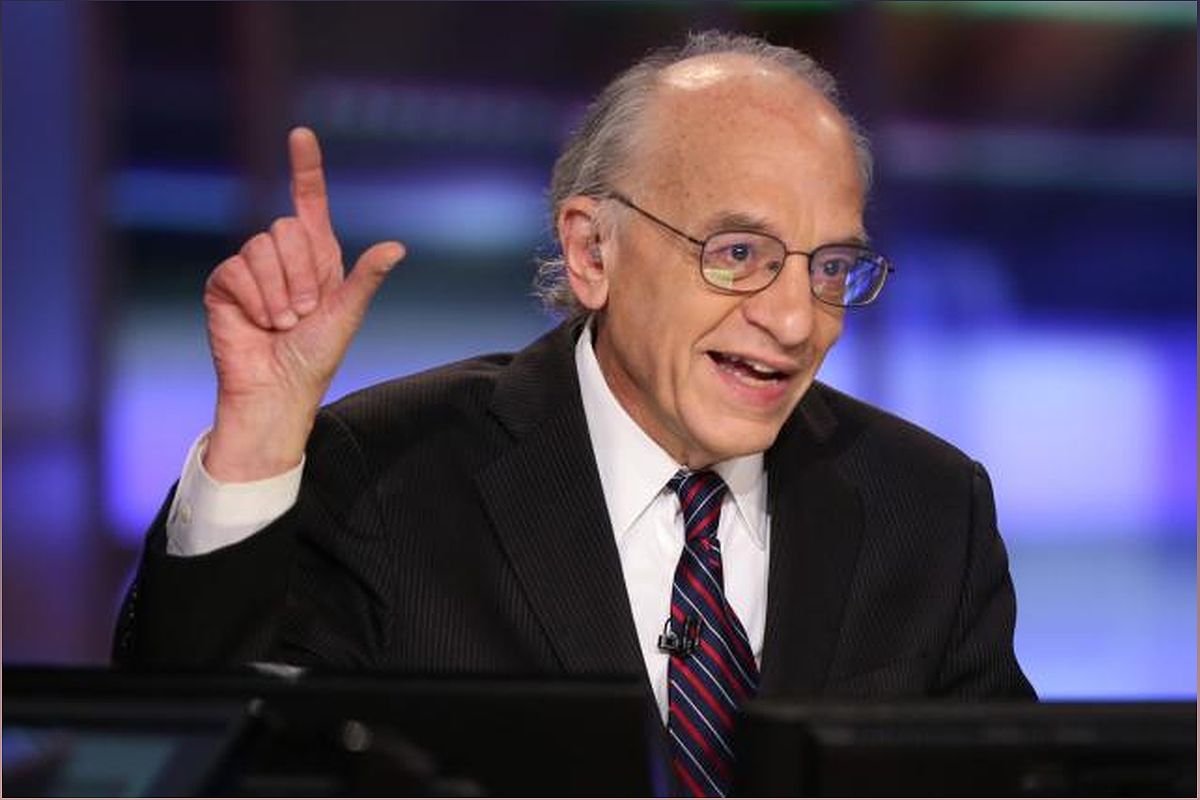

The Federal Reserve's steadfast commitment to its 2% inflation target could have implications for the Dow Jones. While the stock market has been experiencing a Santa Rally and bullish signals, some analysts, including Jeremy Siegel, are concerned that the Fed's focus on inflation fears may hinder the Dow Jones from reaching new all-time highs.

Despite inflation remaining at 3.2%, Fed Chairman Jerome Powell has shown some leniency by holding rates instead of increasing them. However, the question remains whether the Fed's approach will change in the coming months and if it will impact the Dow Jones.

Powell's Hint at a Change in the Fed's Approach

Discover the signals from Fed Chairman Jerome Powell that suggest a potential shift in the central bank's strategy.

While the Federal Reserve has maintained its commitment to the 2% inflation target, Powell's recent statements indicate a possible change in the central bank's approach. During an event at Spelman College, Powell acknowledged the progress made by the economy and emphasized the need for careful forward movement to balance the risks of under- and over-tightening.

This has led some analysts, like Jeremy Siegel, to speculate that there may not be a rate hike at the next meeting. Powell's reluctance to surprise the markets and his acknowledgment of the achieved economic goals suggest a potential shift in the Fed's strategy.

Speculations on Future Rate Cuts

Explore the murmurs of rate cuts in the market and analysts' predictions for the timing of these cuts.

As we approach 2024, market speculations about rate cuts are gaining traction. Goldman Sachs estimates that the Fed will cut rates for the first time in Q4 2024, while Bank of America predicts rate cuts in the middle of 2024. Citigroup expects rate cuts of 100 basis points throughout the next year.

However, Jeremy Siegel remains skeptical and believes that the timing of rate cuts will depend on the strength of the data and whether inflation continues to decrease. It's important to note that the release of the Dot Plot in December will likely generate discussions and reactions regarding the Fed's stance on rate hikes.

The Fed's Forecasting Record and Its Implications

Consider the reliability of the Fed's forecasts and the potential impact on market sentiment.

Jeremy Siegel highlights the importance of considering the Fed's forecasting record when interpreting their statements. He suggests that social media may be abuzz with comments about the perceived hawkishness of the Dot Plot, but it's crucial to remember the Fed's track record in accurately predicting market outcomes.

While the Fed's forecasts can influence market sentiment, investors should approach them with caution and consider other factors that may impact the stock market's performance.