As we head into 2024, investors are closely monitoring the performance of tech giants such as Apple, Microsoft, Amazon, Nvidia, Alphabet, Meta, and Tesla. These companies have been at the forefront of innovation and have significantly impacted the stock market. While the soft-landing scenario suggests further gains for US stocks, the wild outperformance of these tech giants may be subdued. Let's take a closer look at each company's standing and what lies ahead for them. Apple, with its market-leading position, has seen a remarkable 50% surge this year, making it the world's most valuable company. Microsoft, on the other hand, is well-positioned to capitalize on the potential of AI, thanks to its integration of OpenAI's ChatGPT technology. Amazon's rise has been driven by its AWS cloud unit, while Nvidia has become an AI darling with its booming revenue growth. Alphabet, Google's parent company, is a strong competitor in AI and cloud products, and Meta continues to dominate the social media landscape. Lastly, Tesla, despite some recent challenges, remains a leader in the electric-vehicle race. With their unique strengths and growth potential, these tech giants are poised to shape the future of the industry. Stay informed and make informed investment decisions as we navigate the ever-evolving tech landscape.

Apple's Market Dominance and Growth Potential

Apple has emerged as the world's most valuable company, with a market value surpassing $3 trillion. Its market-leading position and continuous innovation have contributed to its impressive 50% surge this year. But what lies ahead for Apple?

Despite challenges such as a potential recovery in cyclical sales and the need for growth in China's consumer market, Apple's unique offerings and brand loyalty continue to position it for success. As the tech landscape evolves, investors are keen to see if Apple can maintain its dominance and find new avenues for growth.

Microsoft's AI Potential and Cloud Growth

Microsoft has reached all-time highs this year, driven by optimism surrounding its AI and cloud growth. With the integration of OpenAI's ChatGPT technology, Microsoft is well-positioned to capitalize on the potential of AI.

The company's ability to monetize its AI products and its strong presence in the cloud market make it a frontrunner in the race. As AI continues to shape various industries, Microsoft's innovative solutions and strategic partnerships position it for long-term success.

Amazon's AWS and Opportunities in AI

Amazon's rise in the stock market has been fueled by the success of its AWS cloud unit. With an earnings beat and stabilizing growth, investors are optimistic about Amazon's future prospects.

Furthermore, Amazon has significant opportunities in the field of AI, particularly in the cloud. As AI continues to transform industries, Amazon's strong presence and resources position it to capitalize on this growing market.

Nvidia's AI Darling Status and Revenue Growth

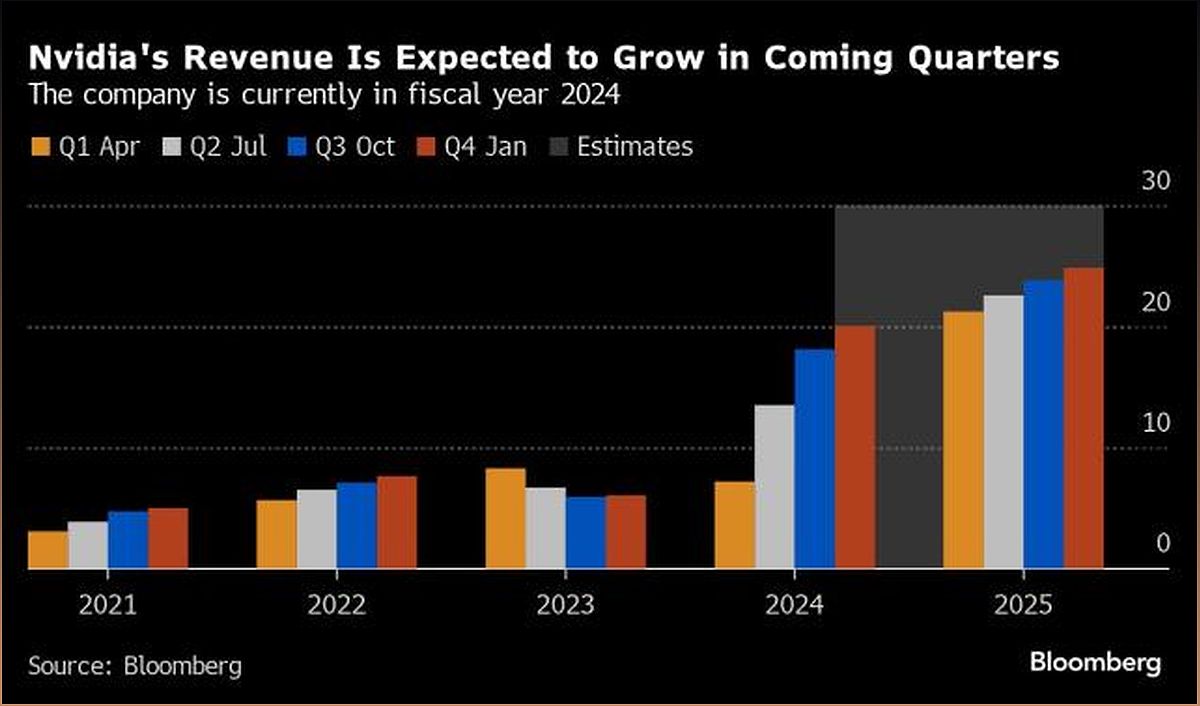

Nvidia has earned its reputation as an AI darling, with its chips driving significant revenue growth. The stock has surged over 200% this year, making it the top performer in both the S&P 500 and the Nasdaq 100.

Analysts have high hopes for Nvidia, with Wall Street's revenue estimates for 2025 soaring. The company's ability to meet the growing demand for its chips and execute its high expectations will be crucial for its continued success.

Alphabet's AI Competition and Valuation

Alphabet, the parent company of Google, is a strong competitor in the AI and cloud products market. With its Gemini AI offering, investors are eager to see a clear path to higher revenue.

From a valuation perspective, Alphabet is relatively reasonably priced compared to other tech giants. As investors evaluate their options, Alphabet's competitive position and valuation make it an intriguing choice.

Meta's Dominance in Social Media and Product Expansion

Meta, formerly known as Facebook, continues to be a high flyer in the era of social media. With shares nearly tripling in 2023, Meta remains a top pick among internet stocks.

The company's multi-year product roadmap, including social, GenAI, and ad tools, has contributed to its expanding engagement and expanding margins. As Meta continues to innovate and expand its offerings, investors are closely watching its performance in the ever-evolving social media landscape.

Tesla's Leadership in Electric Vehicles and Long-Term Potential

Tesla has had a remarkable year, despite some challenges in the industry. As the winner in the electric vehicle race, Tesla's market performance has more than doubled.

While analysts have reduced expectations for deliveries and profits due to cooling industry demand, Tesla's strong brand and ability to tap into trends like AI position it for long-term success. As the electric vehicle market evolves, Tesla's leadership and innovation will continue to shape the industry.